What is Wealth Management?

- Wealth Management is a service that gives clients financial and investment advice, accounting and tax services, retirement planning, legal and real estate planning.

- FSC is built on Client centric model which helps to have a detailed view of the client with their associated relationships, Financial Account, Financial Holdings, Financial Goals, Assets and Liabilities etc…

Wealth Management Personas

- Client

- Advisor

Client

- Client can have 360 degree view of their finances with respect to their households, Businesses and related individuals.

- Client can plan his financial goals, investments and plans according to the detailed finances listed.

Advisor

- A wealth manager/ advisor can study about clients finances, goals and plans and advice accordingly that helps the advisor.

- A wealth manager/ Advisor can build 1-to-1 relationships with clients for key investment decisions.

- A wealth manager/Advisor coordinates with financial experts, attorneys, accountants and insurance agents to give consolidated advice for client’s long term goals

- A wealth manager/Advisor work with the following kinds of accounts.

- Investment accounts

- Bank accounts

- Insurance policies

- Assets and liabilities, such as a home mortgage

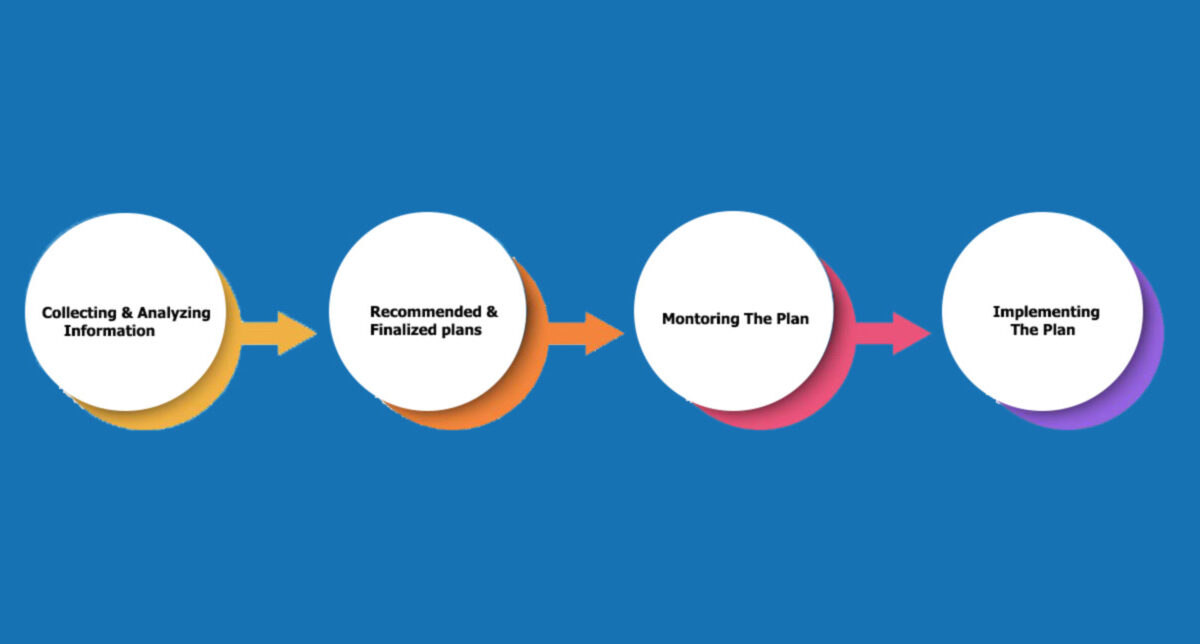

Process

- Advisor gathers information about client’s current finance situation and guide them with their objectives like

- Investment Planning

- Income Tax Planning

- Retirement Planning

- Insurance Planning

- Business Planning

- Education Planning

- Cash Flow Analysis etc.

- Once the objective of the client is finalized Advisor helps to analyse the information, recommend a Plan and implementing the plan.

- Advisors also monitor the plans progress, update and improve the plan and also assist clients with day to day financial decisions