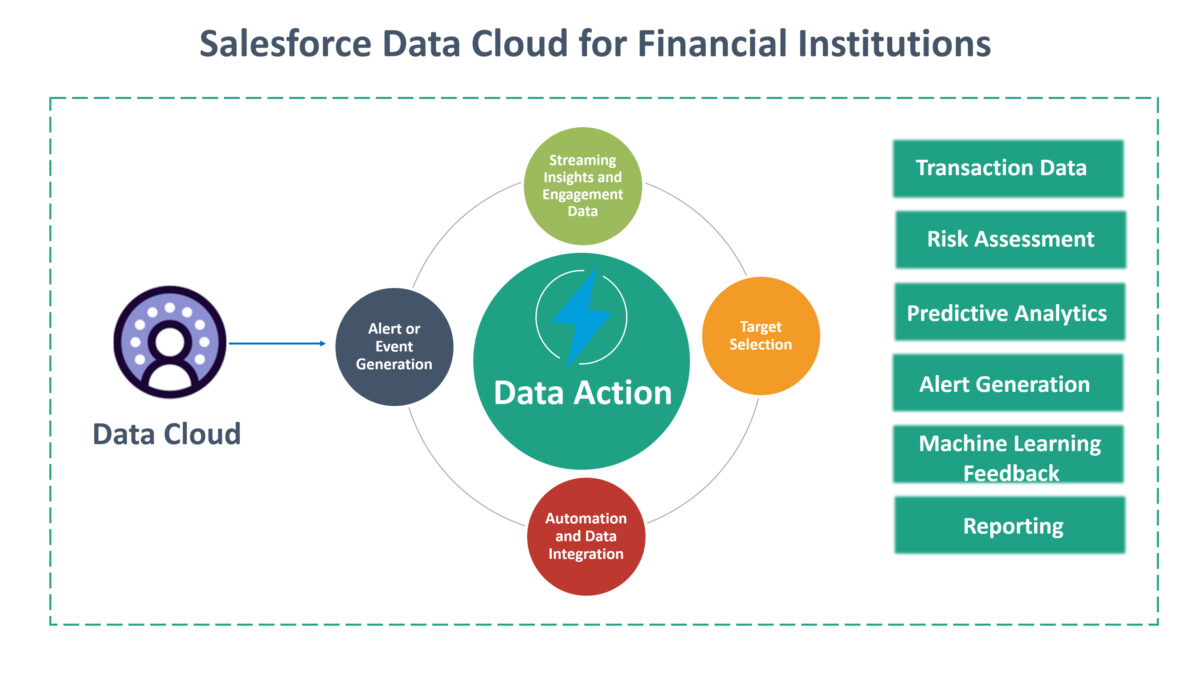

Triggering Alerts for Fraudulent Transactions using AI and Data Cloud to Notify Customers:

In the world of modern finance and digital transactions, the detection and prevention of fraudulent activities are of utmost importance. Leveraging Artificial Intelligence (AI) in conjunction with Data Cloud resources can create a robust system for identifying and responding to fraudulent transactions while also ensuring customers are promptly notified. Here’s how this process works:

- Data Collection and Integration:

- Transaction Data: Financial institutions collect and maintain extensive records of customer transactions. This data includes information such as transaction amounts, locations, timestamps, and more.

- Data Cloud: Data Cloud resources provide access to external datasets, which can include information about known fraud patterns, blacklists of fraudulent entities, and historical fraud data.

- AI-Powered Fraud Detection:

- Machine Learning Models: AI, particularly machine learning, is employed to develop models that can analyse transaction data in real-time. These models are trained to recognize patterns and anomalies associated with fraudulent activities. They continuously learn and adapt to new fraud tactics.

- Predictive Analytics: The AI models can generate risk scores or probabilities for each transaction, indicating the likelihood of it being fraudulent. These scores are based on historical data, known fraud patterns, and real-time inputs.

- Triggering Alerts:

- Thresholds and Rules: Based on the risk scores or predetermined thresholds, the system decides which transactions would need further investigation. Transactions exceeding these thresholds are flagged as potential fraud.

- Alert Generation: Alerts are generated for transactions that meet the criteria for potential fraud. These alerts include details of the transaction, the risk assessment, and any relevant information from Data Cloud resources.

- Customer Notification:

- Real-Time Alerts: Customers are immediately notified when their transaction is flagged as potentially fraudulent. These notifications can be sent through various channels, such as mobile apps, SMS, email, or push notifications.

- Details and Instructions: The alert provides customers with details about the suspicious transaction, including the date, time, location, and amount. It may also include instructions on how to confirm or dispute the transaction.

- Continuous Improvement:

- Machine Learning Feedback: The AI models continue to learn from these real-world experiences. Feedback from confirmed fraudulent transactions is used to refine and improve the accuracy of future fraud detection.

- Compliance and Reporting:

- Regulatory Compliance: Financial institutions ensure compliance with regulatory requirements related to fraud detection and customer notifications.

- Reporting: Transaction data and fraud detection statistics are regularly reported to relevant authorities and stakeholders to maintain transparency and compliance.

- Other Use cases:

- Risk Assessment: Data Cloud can provide data on a client’s financial history, creditworthiness, and risk profile. This information can be valuable for assessing and managing lending, investment, or insurance risk

- Cross-Selling and Upselling: By understanding clients’ financial needs and profiles through Data Cloud, financial advisors can identify opportunities for cross-selling or upselling relevant financial products and services.

- Lead Generation: Data Cloud can be used to identify potential leads and prospects in the financial services industry. This includes finding businesses or individuals who might be interested in wealth management, investment services, insurance, or other financial products